Office of Infrastructure of Canada

Quarterly Financial Report for the quarter ended December 31, 2021

Office of Infrastructure of Canada

Quarterly Financial Report for the quarter ended December 31, 2021

Office of Infrastructure of Canada

Quarterly Financial Report for the quarter

ended December 31, 2021

(PDF Version)

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report has been prepared by management as required by Section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates and Supplementary Estimates for fiscal year 2021-22.

The key to building Canada for the 21st century is a strategic and collaborative long-term infrastructure plan that builds economically vibrant, strategically planned, sustainable and inclusive communities. Infrastructure Canada (INFC) works closely with all orders of government and other partners to enable investments in social, green, public transit and other core public infrastructure, as well as trade and transportation infrastructure.

Further information on INFC’s mandate, responsibilities, and programs can be found in INFC’s 2021-22 Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes INFC’s spending authorities granted by Parliament and those used by INFC consistent with the Main Estimates and Supplementary Estimates for the 2021-22 fiscal year (FY). This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the government. Approvals are given in the form of annually approved limits through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

INFC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

In the past, INFC has worked in collaboration with other federal departments and agencies to deliver some of its transfer payment programs (collectively known as federal delivery partners).

It should be noted that this quarterly report has not been subject to an external audit or review.

Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This section highlights the significant items that contributed to the change in resources available for use from 2020-21 to 2021-22 and in actual expenditures as of December 31, 2020 and December 31, 2021.

Authorities

As shown in the Statement of Authorities, INFC’s total authorities available for 2021-22 are $9.96 billion as of the end of Quarter 3 (Q3) and represent a $1.92 billion increase compared to the same quarter in the prior year (PY).

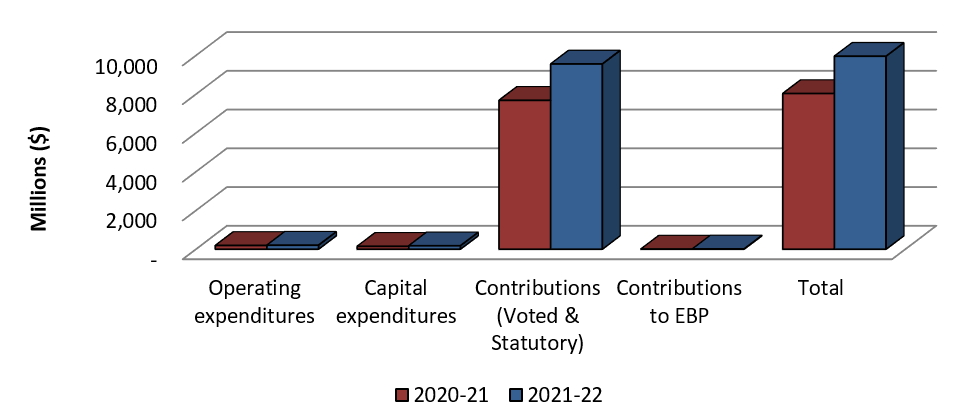

Graph 1: Comparison of Authorities Available as of December 31, 2020 and December 31, 2021.

Text description of Graph 1

Bar graph showing the comparison of authorities available for use as of December 31, 2020 and December 31, 2021.

- Operating authorities available as of Q3 2020-21 were $193.98 million, compared with $207.68 million as of Q3 2021-22.

- Capital authorities available as of Q3 2020-21 were $148.37 million, compared with $176.93 million as of Q3 2021-22.

- Contribution (Voted and Statutory) authorities available as of Q3 2020-21 were $7.68 billion, compared with $9.56 billion as of Q3 2021-22.

- Contributions to the Employee Benefit Plan authorities available as of Q3 2020-21 were $7.76 million, compared with $15.05 million as of Q3 2021-22.

- The total of authorities available for use as of Q3 2020-21 were $8.03 billion, compared with $9.96 billion as of Q3 2021-22.

This increase is summarized in the table below:

Authorities |

Increase/(Decrease) |

% Change vs. prior year |

|---|---|---|

Operating Expenditures |

13,701 |

7.1% |

Capital Expenditures |

28,551 |

19.2% |

Contributions (Voted and Statutory) |

1,873,753 |

24.4% |

Contributions to Employee Benefit Plans (EBP) |

7,297 |

94.1% |

The sources of significant year-over-year changes are summarized as follows:

- Operating Expenditures – This increase is mainly due to funding received to sustain departmental operations from the Program Integrity Treasury Board submission – Strengthen Stewardship of Canadian Infrastructure: Long-Term Resourcing Strategy, as well as new Operating funding required to deliver on three new Programs: Funding to Improve Ventilation in Public Buildings, Green and Inclusive Community Buildings Program and Permanent Public Transit Fund.

- Capital Expenditures – Unused funds from 2020-21 were made available in 2021-22 to meet existing contractual obligations as well as ensure a contingency was available to address any unforeseen event or changes for the Samuel De Champlain Bridge Corridor (SDCBC) project.

- Contributions (Voted and Statutory) – This net increase is mainly due to the top up to the Canada Community-Building Fund (CCBF) announced in Budget 2021 offset by a decrease in historical programs authorities as these programs approach end of life cycle.

- Contributions to Employee Benefit Plans – This increase is reflective of the growth in full time equivalents (FTEs) associated with the new Programs listed in the Operating Expenditures section.

Expenditure Analysis

Expenditures at the end of Q3 were $6.03 billion, compared to $3.25 billion reported in the same period of 2020-21, representing an increase of 85.7% between Q3 of the two years. The source of the relative increase is demonstrated in the tables, graphs and analysis below.

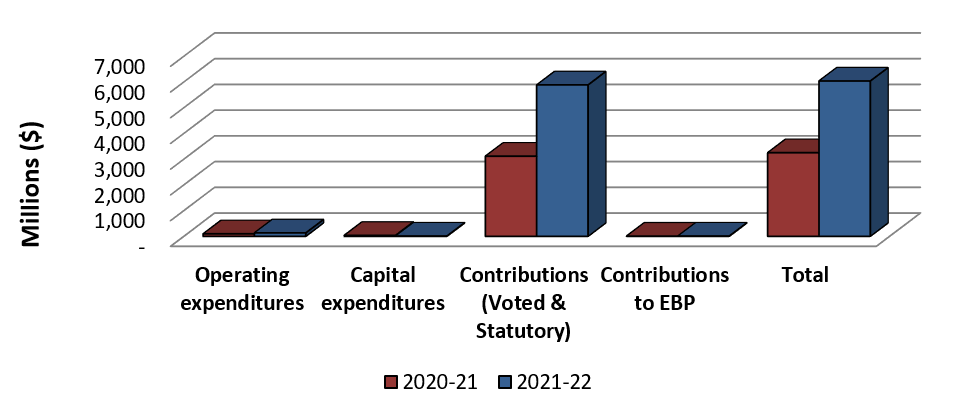

Graph 2: Comparison of Total Expenditures as of as of December 31, 2020 and December 31, 2021.

Text description of Graph 2

Bar graph showing the comparison of total expenditures used year-to-date as of December 31, 2020 and December 31, 2021.

- Authorities used for Operating as of Q3 2020-21 were $95.57 million, compared with $132.3 million as of Q3 2021-22.

- Authorities used for Capital as of Q3 2020-21 were $35.74 million, compared with $10.26 million as of Q3 2021-22.

- Authorities used for Contributions (Voted and Statutory) as of Q3 2020-21 were $3.11 billion compared with $5.88 billion as of Q3 2021-22.

- Authorities used for Contributions to the Employee Benefit Plan as of Q3 2020-21 were $5.82 million, compared with $7.93 million as of Q3 2021-22.

- Total year-to-date budgetary expenditures as of Q3 2020-21 were $3.25 billion, compared to $6.03 billion as of Q3 2021-22.

Year-to-date expenditures |

Increase/(Decrease) |

% Change vs. prior year |

|---|---|---|

Operating Expenditures |

36,725 |

38.4% |

Capital Expenditures |

(25,480) |

(71.3%) |

Contributions (Voted and Statutory) |

2,772,226 |

89.1% |

Contributions to Employee Benefit Plans |

2,112 |

36.3% |

The sources of significant year-over-year changes are summarized as follows:

- Operating and Capital Expenditures – Further details are provided later in this report, by standard object.

- Contributions (Voted and Statutory) – Further details by program are provided below.

- Contributions to Employee Benefit Plans – The increase in INFC’s contribution to the Employee Benefit Plan is directly attributable to an increase in the number of FTEs currently employed at INFC.

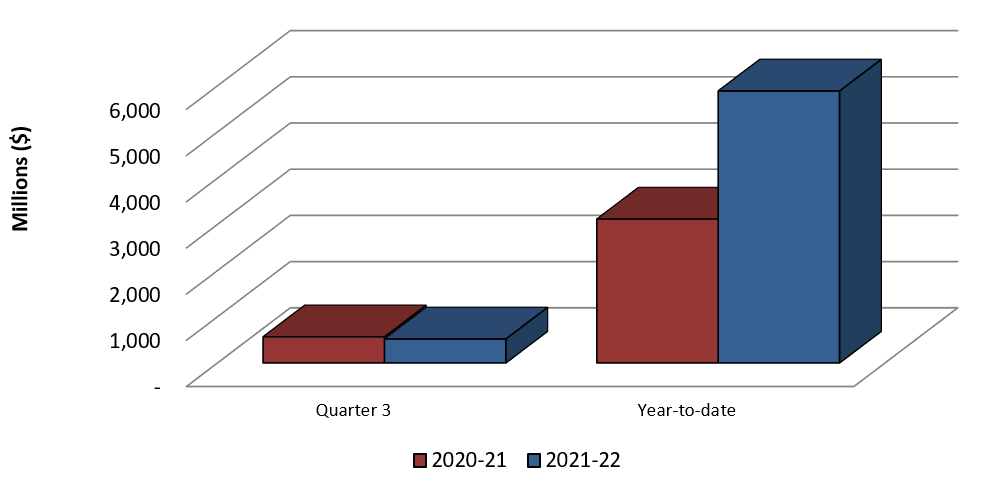

Graph 3: Comparison of Authorities Used for Contributions as of December 31, 2020 and December 31, 2021

Text description of Graph 3

Bar graph showing the comparison of authorities used for Contributions (Voted) and Contributions (Statutory) as of December 31, 2020 and December 31, 2021.

- Contributions (Voted and Statutory) expensed in the quarter were $563.7 million as of Q3 2020-21, compared to $516.4 million as of Q3 2021-22.

- Contributions (Voted and Statutory) expensed year-to-date as of the end of Q3 2020-21 were $3.11 billion, compared to $5.88 billion as of Q3 2021-22.

Significant changes in year-to-date contribution expenditures between December 2020 and December 2021 were as follows:

Program Fund |

Increase/(Decrease) |

% Change vs. prior year |

|---|---|---|

Canada Community-Building Fund (CCBF) - Statutory |

2,319,767 |

107% |

Investing in Canada Infrastructure Program - Public Transit Infrastructure Stream (PTIS) |

167,288 |

15628% |

New Building Canada Fund-National Infrastructure Component (NBCF-NIC) |

113,759 |

293% |

Investing in Canada Infrastructure Program - COVID-19 Resilience Stream (ICIP-CVRIS) |

103,754 |

N/A |

Public Transit Infrastructure Fund (PTIF) |

56,553 |

50% |

New Building Canada Fund-Provincial-Territorial Infrastructure Component-National and Regional Projects (NBCF-PTIC-NRP) |

47,845 |

14% |

Investing in Canada Infrastructure Program - Rural & Northern Infrastructure Stream (ICIP-RNIS) |

32,085 |

945% |

Investing in Canada Infrastructure Program - Green Infrastructure Stream (ICIP-GIS) |

26,359 |

174% |

Clean Water Wastewater Fund (CWWF) |

(41,299) |

(50%) |

The sources of significant year-over-year changes are summarized as follows:

- CCBF – Similar to 2020, the Canada Community-Building Fund (previously named as Gas Tax Fund) was accelerated this year and provided in a single payment in June to help Canadian communities recover from the COVID-19 pandemic as quickly as possible while respecting public health guidelines. As the allocation is indexed, the FY 2021-22 allocation was $2.27 billion, which is 5% higher than FY 2020-21. In addition, top-up payments were released in July for a total amount of $2.22 billion.

- ICIP-PTIS – More claims were received and processed for Alberta, British Columbia, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island and Quebec under the PTIS stream by the end of Q3 2021-22, compared to 2020-21.

- NBCF-NIC – All the contribution agreements in this program have now been signed. Many of the projects are under implementation which is contributing to claims being higher than the previous year.

- ICIP-CVRIS – This stream is planning to spend $1 billion more this year compared to FY 2020-21. To date $103.8 million in claims has been paid, compared to zero in FY 2020-21. More claims are forecasted to be received in FY 2021-22.

- PTIF – In the next two years, a significant number of projects are expected to be completed. To date Québec, Ontario, British Columbia, Alberta and Manitoba have submitted $170.6 million in claims, compared to $114 million by the end of Q3 2020-21.

- NBCF-PTIC-NRP – More claims were received and processed by the end of Q3 2021-22, compared to 2020-21.

- ICIP-RNIS – More claims were received and processed for Alberta, Manitoba, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island and Quebec by the end of Q3 2021-22, compared to 2020-21.

- ICIP-GIS – More claims were received and processed for Alberta, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island under the GIS stream by the end of Q3 2021-22, compared to 2020-21.

- CWWF – The program is sunsetting. In the next two years, a significant number of projects are expected to be completed. Less claims were received and processed by the end of Q3 2021-22, compared to 2020-21.

Departmental Budgetary Expenditures by Standard Object

The planned Departmental Budgetary Expenditures by Standard Object are set out in the table at the end of this report. Aggregate year-to-date expenditures in 2021-22 increased by $2.8 billion, compared with the same quarter last year. The largest single factor was an increase in transfer payments as explained above.

A breakdown of variances in year-to-date spending by standard object is below:

Changes to Expenditures by Standard Object |

Increase/(Decrease) |

% Change vs. prior year |

|---|---|---|

Transfer payments |

2,772,226 |

89.1% |

Public Debt Charges |

28,768 |

N/A |

Personnel |

16,232 |

29.4% |

Repair and Maintenance |

2,551 |

29.8% |

Transportation and Communication |

457 |

368.8% |

Rentals |

325 |

27.7% |

Acquisition of Machinery and Equipment |

150 |

22.0% |

Information |

21 |

7.2% |

Utilities, materials and supplies |

(5) |

(19.5%) |

Professional and Special Services |

(6,834) |

(17.8%) |

Acquisition of Land, Buildings and Works |

(13,540) |

(75.4%) |

Other Subsidies and Payments |

(14,768) |

(100%) |

The sources of significant year-over-year changes are summarized as follows:

- Transfer payments – Details were previously discussed.

- Public debt charges – The increase is explained by an interest expense payment made for the Samuel De Champlain Bridge Corridor (SDCBC). These payments were previously coded under Other subsidies and payments.

- Personnel – Increase in the number of employees.

- Repair and maintenance – The increase is mainly related to SDCBC as the project is in the Operating and Maintenance phase.

- Transportation and communications – The increase is related to increased spending on mobile devices and monthly services fees, and IT platform solutions to support current and future transfer payment program information management applications.

- Rentals – The increase is mainly due to licensing costs for applications such as Microsoft 365, Billie Reservation Application, and SAP.

- Acquisition of machinery and equipment – This increase is mainly due to spending related to the purchase of IT equipment.

- Professional and special services – The decrease is due to reduced engineering consultation costs related to payments for the Réseau Express Métropolitain (REM) project, which are reimbursed based on an agreement between REM Inc. and INFC.

- Acquisition of land, buildings and work – The decrease is related to the monthly capital payment made for the SDCBC project. The capital portion of the monthly payment was higher during the year in 2020-21, but was later adjusted based on the Present Value calculation table – a new approach that was recommended by the Office of the Comptroller General.

- Other subsidies and payments – The interest expense payment made for the SDCBC project was reported under this standard object in 2020-21. As per Receiver General recommendation, interest payment for SDCBC are now coded under Public debt charges.

Overall, INFC has spent 60.6% of its current Total Authorities as of December 31, 2021, compared to 40.4% at the end of Q3 of the previous fiscal year.

Risks and Uncertainties

In most cases, INFC funds projects via a Contribution Agreement or Integrated Bilateral Agreement between Canada and a Provincial/Territorial (PT) government. PT governments then enter into their own agreements with municipalities, who are ultimately responsible for project management and construction of the infrastructure.

Most of INFC’s programs are structured in such a way that funding flows from the Department based on requests for reimbursements. It is important to note that federal spending is not an accurate measure of when the economic activity created by infrastructure spending occurs. When projects are approved, work begins and economic activity is generated by provinces, territories and municipalities, which are responsible for implementing projects and incurring costs. INFC makes the federal contribution only when requested by partners.

There are a variety of reasons that can affect the timing of requests for reimbursements, which can contribute to a variance between planned spending and actual spending. Some projects, once approved, move quickly into the construction phase while others have longer lead times for planning, and local approval processes (e.g. zoning and permitting). Regardless of how long planning takes or how soon ground can break, eligible costs can be submitted for reimbursement throughout the life of the project.

INFC encourages PTs to submit claims in a timely manner to ensure the flow of funding as planned. Parliamentary authority to spend typically expires at the end of the fiscal year; however, in response to the needs of its project partners, INFC reprofiles its authorities as needed so that the funding committed to specific projects continues to be available in future years when needed.

In addition, INFC has worked with provinces and territories to introduce improvements to the flow of funding processes to better align authorities of existing programs to expenditures and improve predictability of high materiality projects. It also used lessons learned from legacy programs to introduce additional flexibilities in the design of new programs such as flexibility in funding mechanism and basis of payments. These efforts should yield important impacts over the coming years.

INFC is committed to making infrastructure investments that support economic growth and job creation, help combat the effects of climate change, and build inclusive communities. While COVID-19 has not changed these priorities, the Department is focused on doing more with its existing resources and building back better. As current programs are adapted and a suite of new programming is launched, resource management practices and sound financial stewardship are key and center in ensuring successful delivery. Although recipients continue to experience constraints resulting from COVID-19 which affect the implementation of new projects, INFC is committed to provide funding to them in a timely fashion.

Therefore INFC is focusing efforts on attracting and retaining employees with the skill sets and experience necessary to fulfil the department’s evolving mandate, and on implementing additional flexibilities to allow provinces and territories more time for the completion of projects under several programs. For example, the ICIP COVID-19 stream has been extended to allow projects by provinces to be completed by December 31st, 2023 and projects in the territories and in remote communities must be completed by December 31st, 2024.

Significant Changes in Relation to Operations, Personnel and Programs

Infrastructure Canada continues to grow and evolve. Since the last Quarterly Financial Report, the following significant changes have taken place within the department:

- The appointment of Minister LeBlanc as Minister of Intergovernmental Affairs, Infrastructure and Communities on October 26, 2021;

- The appointment of Minister Hussen as Minister of Housing and Diversity and Inclusion on October 26, 2021,

- Infrastructure of Canada is to provide support to the Minister of Housing and Diversity and Inclusion in carrying out his responsibilities.

Approval by Senior Officials

Approved by:

Kelly Gillis

Deputy Head

Nathalie Bertrand

Chief Financial Officer

Signed at Ottawa, Canada

Office of Infrastructure Canada

Quarterly Financial Report

For the quarter ended December 31, 2021

Departmental budgetary expenditures by Standard Objects (unaudited)

(in thousands of dollars)

Fiscal year 2021-22

| N/A | Planned expenditures

for the year ending March 31, 2022 |

Expended during the

quarter ended December 31, 2021 |

Year-to-date used

at quarter-end |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 103,742 | 25,680 | 71,461 |

| Transportation and communications | 1,907 | 175 | 581 |

| Information | 605 | 79 | 321 |

| Professional and special services | 54,658 | 5,862 | 31,493 |

| Rentals | 2,607 | 671 | 1,497 |

| Repair and maintenance | 41,616 | 4,227 | 11,101 |

| Utilities, materials and supplies | 340 | 11 | 21 |

| Acquisition of land, buildings and works | 151,365 | 1,673 | 4,417 |

| Acquisition of machinery and equipment | 2,344 | 699 | 828 |

| Transfer payments | 9,558,258 | 516,364 | 5,885,081 |

| Public debt charges | 40,483 | 10,771 | 28,768 |

| Other subsidies and payments | - | - | (1) |

| Total net budgetary expenditures | 9,957,925 | 566,212 | 6,035,568 |

Departmental budgetary expenditures by Standard Objects (unaudited)

(in thousands of dollars)

Fiscal year 2020-21

| N/A | Planned expenditures

for the year ending March 31, 2021 |

Expended during the

quarter ended December 31, 2020 |

Year-to-date used

at quarter-end |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 65,731 | 20,448 | 55,229 |

| Transportation and communications | 1,563 | 84 | 124 |

| Information | 659 | 44 | 300 |

| Professional and special services | 174,012 | -14,258 | 38,326 |

| Rentals | 1,494 | 303 | 1,172 |

| Repair and maintenance | 46,238 | 3,388 | 8,549 |

| Utilities, materials and supplies | 163 | 7 | 26 |

| Acquisition of land, buildings and works | 29,599 | 6,453 | 17,957 |

| Acquisition of machinery and equipment | 3,048 | 334 | 679 |

| Transfer payments | 7,684,506 | 563,765 | 3,112,855 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 27,610 | 5,535 | 14,767 |

| Total net budgetary expenditures | 8,034,623 | 586,102 | 3,249,984 |

Download

If the following document is not accessible to you, please contact infc.info.infc@canada.ca for assistance.

- Departmental budgetary expenditures by Standard Objects (PDF version) (21.25 KB)

Office of Infrastructure Canada

Quarterly Financial Report

For the quarter ended December 31, 2021

Statement of Authorities (unaudited)

(in thousands of dollars)

Fiscal Year 2021-22

| N/A | Total available for use for the year ending March 31, 2022 |

Used during the quarter ended December 31, 2021 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Operating expenditures | 207,595 | 43,576 | 132,239 |

| Vote 5 – Capital expenditures | 176,927 | 3,614 | 10,262 |

| Vote 10 – Contributions | 5,068,176 | 516,364 | 1,394,998 |

| Budgetary Statutory Authorities | |||

| (S) – Contributions to employee benefit plans | 15,054 | 2,643 | 7,929 |

| (S) – Canada Community-Building Fund | 4,490,082 | - | 4,490,082 |

| (S) – Minister salary and car allowance | 91 | 15 | 56 |

| Total Budgetary Authorities | 9,957,925 | 566,212 | 6,035,568 |

| Non-Budgetary Authorities | - | - | - |

| Total Authorities | 9,957,925 | 566,212 | 6,035,568 |

Statement of Authorities (unaudited)

(in thousands of dollars)

Fiscal Year 2020-21

| N/A | Total available for use for the year ending March 31, 2021 |

Used during the quarter ended December 31, 2020 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Operating expenditures | 193,895 | 32,320 | 95,502 |

| Vote 5 – Capital expenditures | 148,376 | -11,946 | 35,742 |

| Vote 10 – Contributions | 5,514,190 | 563,765 | 942,539 |

| Budgetary Statutory Authorities | |||

| (S) – Contributions to employee benefit plans | 7,757 | 1,939 | 5,818 |

| (S) – Canada Community-Building Fund | 2,170,316 | - | 2,170,316 |

| (S) – Minister salary and car allowance | 89 | 22 | 67 |

| Total Budgetary Authorities | 8,034,623 | 586,102 | 3,249,984 |

| Non-Budgetary Authorities | - | - | - |

| Total Authorities | 8,034,623 | 586,102 | 3,249,984 |

Download

If the following document is not accessible to you, please contact infc.info.infc@canada.ca for assistance.

- Statement of Authorities (PDF version) (18.79 KB)

Report a problem on this page

- Date modified: